Bitcoin Cash Hits New 2025 High Amid Growing Interest

Bitcoin Cash (BCH), one of the prominent altcoins in the crypto ecosystem, has just reached a new high for 2025 and recorded a significant increase in investor interest.

Bitcoin Cash stands out as a special case. Its price has risen steadily, even though it isn’t part of the companies’ strategic reserve accumulation trend. The project has no major new developments and rarely appears in expert discussions.

Bitcoin Cash Quietly Breaks New Records in June

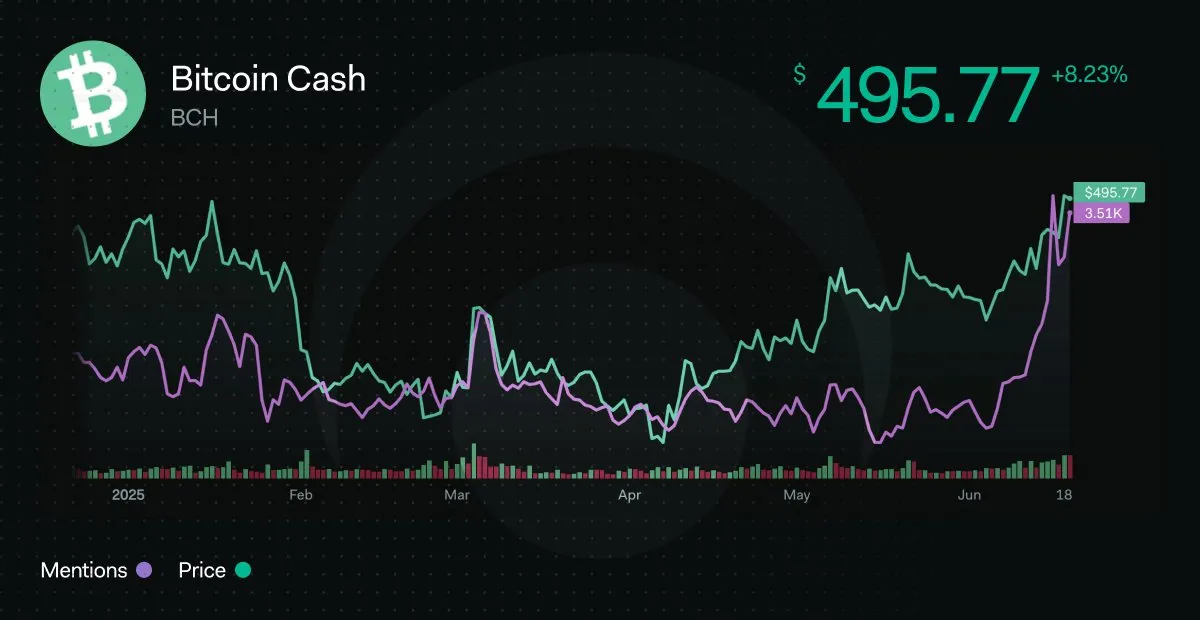

According to TradingView data, BCH price has increased for three consecutive months—from $253 to over $489, a 98% rise. With this increase, BCH has surpassed SUI and LINK in capitalization to rank 12th in the market.

At one point, BCH surpassed $500, officially setting a new 2025 high. Very few altcoins have achieved this milestone, especially amid a lingering altcoin winter.

Alongside this, Bitcoin Cash’s market cap dominance rose from 0.2% in March to 0.3% in June, which indicates that capital continues to flow into BCH.

Additionally, data from LunarCrush shows that BCH’s social activity has hit its highest level in 2025. This metric measures how often BCH is mentioned in discussions across social media platforms.

Google Trends data supports this. Searches for the keyword “Bitcoin Cash” peaked at a score of 100 on June 20, the maximum level in the past 90 days.

Another sign of rising interest is BCH’s trading volume. According to CoinMarketCap, daily trading volume rose from $200 million earlier this month to over $700 million.

These data points clearly show that investors are paying renewed attention to Bitcoin Cash. A recent analysis by BeInCrypto predicts BCH could break above $500 and reach over $550.

What’s Driving the BCH Surge?

Some investors are puzzled by BCH’s price momentum. This altcoin attracts less institutional attention than names like SOL, XRP, or Hyperliquid.

Bitcoin Cash also lacks viral narratives in the community. Its last major upgrade happened over a month ago. However, BCH’s supply distribution offers certain advantages. It shares similarities with Bitcoin.

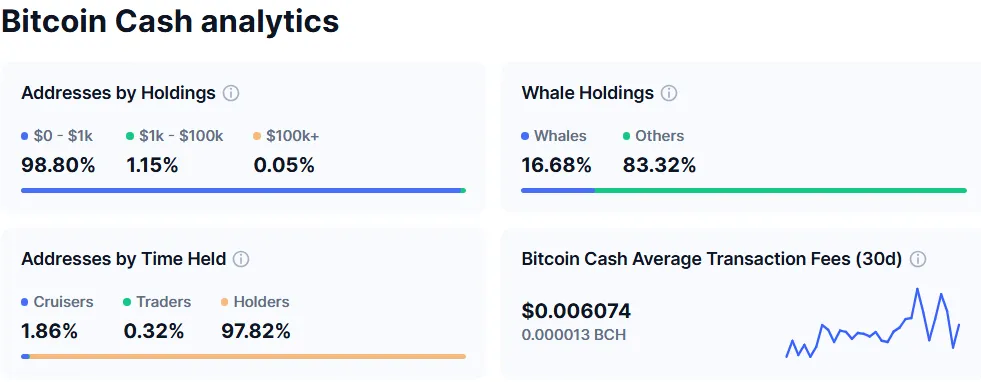

CoinMarketCap data shows that BCH has a fixed supply of 19.8 million and is already in circulation. Additionally, BCH features low transaction fees. User demand remains steady, with over 53,000 transactions per day on average.

Moreover, over 97% of BCH wallets are held by long-term holders, who have kept BCH for over a year. The whale wallet ratio—wallets holding more than 1% of the supply—is about 17%. Together, these factors support a positive long-term supply-demand dynamic.

“[BCH surged] Because it’s an upgrade and better than Bitcoin, and the maxis can’t hold it down anymore. Why buy Bitcoin for $100,000 when you can get Bitcoin Cash for $500? Both have only 21 million in supply, both use the same algorithm, and BCH actually has a larger block size,” one investor commented on X.

The question now is whether this trend can sustain itself in the long term or if it’s just a temporary price spike. Despite nearly doubling in three months, BCH remains far below its $1,600 all-time high set in 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.